Hi guys,

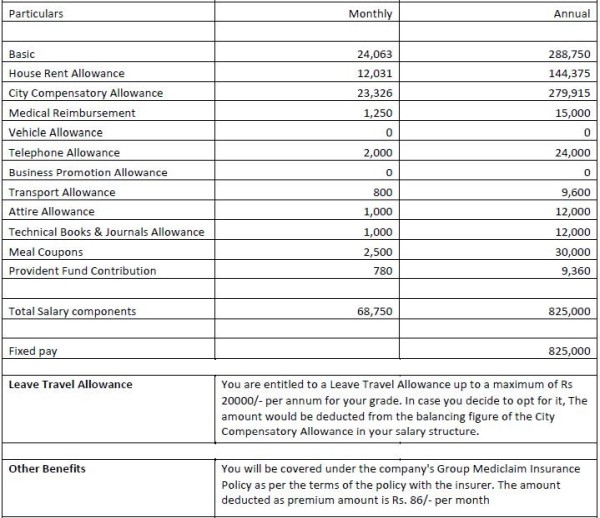

I am from IIM Indore and have received a job offer (in Mumbai, India) whose CTC structure is given in the attached image. Can someone guide me as to what shall be my in-hand or net salary? Will I get paid the various allowances like telephone allowance/attire allowance, etc.? I shall be helpful if you guys can guide me as I am a fresher with no previous experience in HR/tax matters...

CAclubindia

CAclubindia