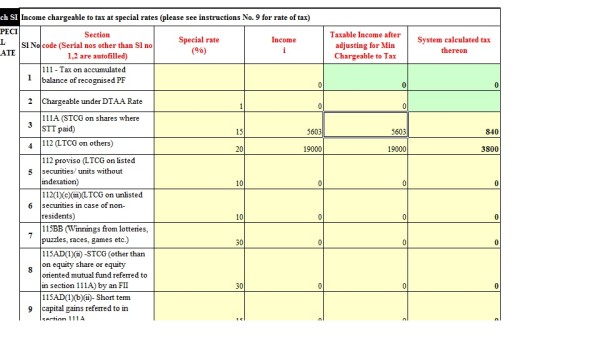

I have total STCG(shares) of Rs 200000. I am trying to file return in ITR 2, but instead of it getting adjusted against basic exemption limit it calculates tax at 15%. The amount entered is only in CG sheet with all the calculation. Can someone explain how do i utilise basic exemption limit

Menu

Unable to utilise basic exemption limit

Replies (5)

Recent Threads

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

- Taxation for sale and purchase of REIT shares

- PAN - AADHAR LINK

- RECONCILIATION OF GSTR 2B Vs BOOKS WITH VBA

- Regarding cancellation of GST Number

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

Related Threads

CAclubindia

CAclubindia