Respected Experts,

I had filed 27Q returns for Q4 of 2024-25, however I submitted the return with wrong deduction dates.

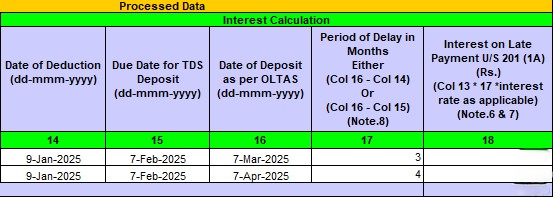

For Q4 months of JAN-FEB-MAR, I had (mistakenly) entered the same deduction date of 09/01/2025 while actually paying (depositing) the TDS on time for each month.

Month - Deduction Date

JAN - 09/01/2025 (Correct)

FEB - 09/01/2025 (Wrong. Should have been 09/02/2025)

MAR - 09/01/2025 (Wrong. Should have been 09/03/2025)

Now I see the 'DEFAULTS' status for 27Q Q4 regular return statement with XXX amount payable for 3(b) INTEREST ON LATE PAYMENT as type of default.

I downloaded the JUSTIFICATION REPORT and this is when I realized I had entered wrong deduction dates for the months of FEB and MAR. Same deduction date of 09/01/2025 for both the months.

I also see one Unconsumed Challans (Date of Deposit 07-May-2025) inside Traces dashboard.

When I try to proceed with REQUEST FOR CORRECTION (online/offline), I get the following error.

No data available for the specified search criteria.

Reasons can be:

1) There is no statement filed for the searched criteria. Please verify FY, Q, FT are entered correctly.

2) The statement is filed and is being processed in CPC TDS. Please try after some time.

3) The original statement filed is a paper return.

Please help me fix this.

Your knowledgable guidance would really help.

Best Regards.

CAclubindia

CAclubindia