Chartered Accountant

594 Points

Joined December 2012

Hi,

I would like to opine as follows:

Section 195 is applicable irrespective of PE or not, so payments to non resident shall be subject to provisions of section 195 and as per section 195 income tax which is chargeable in India shall be deducted .

The issue here is whether the services rendered by the USA company are taxable in India , so here section 9 comes into play which stipulates income deemed to accrue or arise in India, if the services are in the way of royalty and fees for technical services and it relates to business carried on by the payer in India then it is deemed to accrue or arise in india . If the foreign comapny has pan then it can be assumed that it has a permanent establishment in india and even business income is chargeable to tax in india , other wise income from business connection need not be taxed in India.

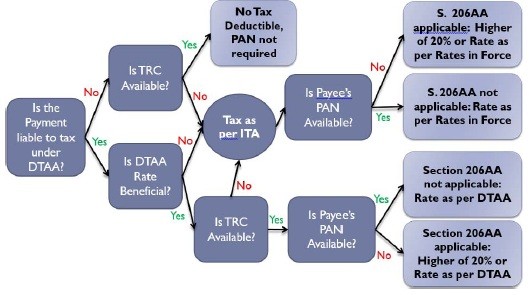

As there would be double taxation of the foreign comapnies income as per section 90 releif is given by way of DTAA and the rate which is more benificail to the assessee will be taken into consideration .

And there is a litigative matter where if PAN is not available then whether 20% should be deducted or not and recently tribunal had given verdict that sec 206AA cannot over ride section 90 thus higher deduction of 20% is not applicable.

In short payments to non resident is a vast subject and cannot be clarified in here with only one perspective , it depends on facts and circumstances of the case.

Hope my opinion prooved useful for further discussion you can contact me through following:

Mail : kulkarni.king @ gmail.com

Ph : 8951210698

CAclubindia

CAclubindia