Hi All,

I had one query regarding filing ITR for which I request your assistance.

My Scenario:

In context of financial year 2017 – 2018 I worked for an organization from 1 April 2017 – 15 November 2017 only.

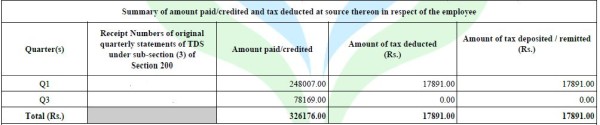

In my Form 16 Part A I got 326176/- Gross Salary for Q1(April-June 2017) & Q3 (October 2017) months & Tax deduction of 17891/- which is mentioned in below screenshot.

I didn’t get any salary for Q2 because due to some unavoidablel reasons I took off from the job for some months in between.

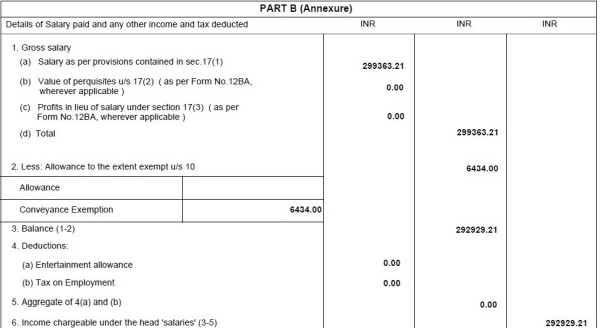

In Form 16 Part B the Gross salary mentioned by Employer is 299363.21/- for period of 1 April 2017 - 15 November 2017

So there is a difference of 26812.79/- in Gross Salary in between Form 16 A & B which is due to the penealty/deduction for Leave without Pay in various components of salary structure.

My Basic Salary = 20833/-

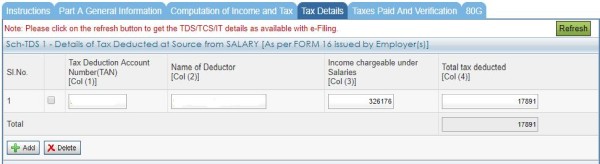

My Query : On Incometax portal I am confused which Gross Salary I have to mentioned in section of “Computation of Income and tax” either from Form 16 A or B?

Because in Tax detail section -> Income chargeable under salaries = 326176 (Details from Form A) & Total tax = 17891/-

Appreciate your inputs for this query and thanks in advance.

Attached File : 2498731 20180726145614 itr ps.jpg downloaded: 83 times

CAclubindia

CAclubindia