Greetings.

I am a disabled person having 80 percent disability due to Arthritis. I wish to file my income tax return for the next year for which I want to get some help.

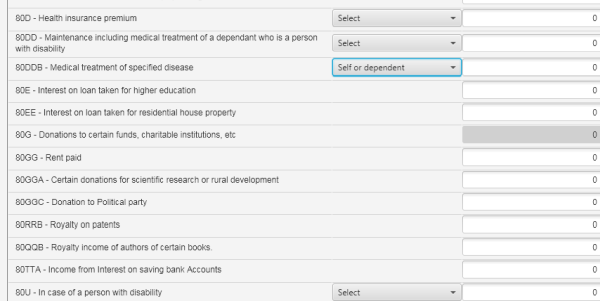

I see there are two deduction sections of my interest in the ITR-80DDB and 80U. While one says you can claim a deduction for medication of your disease(which is around 40K/Year for me) and under 80U you can take the benefit of being severely disabled.

My question is If I take a claim under 80U of 1,25,000, am I liable to claim 40K/year in 80DDB too? Or is it an illegal thing to do i.e. Medication is already covered in 80U?

I am liable to pay a tax of around 31000-One would try how he/she can save the tax which is the same for me but I do not want to save the tax illegally.

Any insights on this would be greatly appreciated.

PS My background is from IT so explain as if you are explaining it to a noob person.

Thanks.

Thank you for the reply.

Thank you for the reply.

CAclubindia

CAclubindia