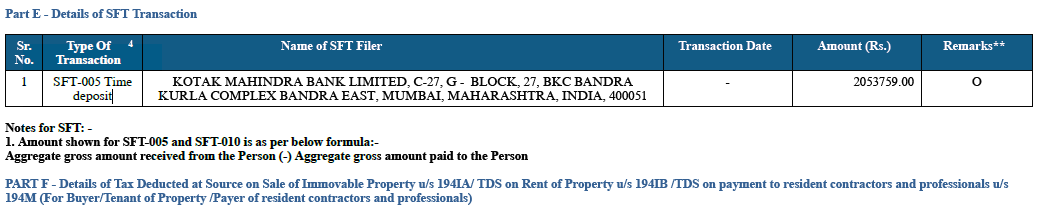

While filling my ITR, I noticed that in Form 26AS I have around 20L shown under "SFT-005 Time deposit" and 'O' as Remarks, as shown below:

I have already disclosed ~1L as "Interest Income".

I do not have any other source of income and all the money in my bank account is from monthly deposits by my son for my livelihood and leisure expenses.

Do I need to worry about this "SFT-005 Time deposit"?

Do I need to do something for this while submitting ITR?

Do I need my son need to do something for this while submitting his ITR?

CAclubindia

CAclubindia