Hello All ,

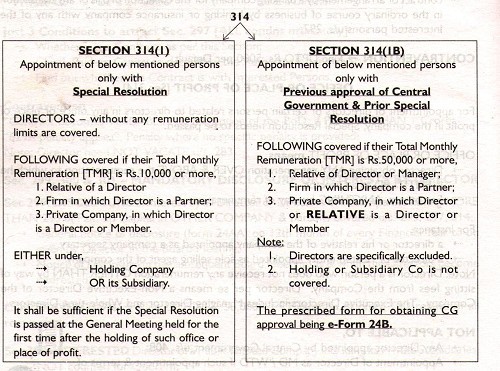

Case 1 : A director of Private limited company is paid remuneration as consulting and technical service fee (Rs.100000 per month) on which TDS as per section 194J of IT act is deducted . Does this attract special resolution u/s 314 as the remuneration is paid in the capacity other than as Director ??? Whats the procedure required ??/

Case 2. A director of a private limited company is paid monthly salary of Rs.2 lakh per month in the capacity of Director . Does this attract any procedure u/s 314 ???

Case 3. Daughter of Director is appointed as Office Manager with a monthly salary of Rs.50,000/- pm and Son is appointed as HR Manager with salary of Rs.25000/- pm . Whats the procedure required u/s 314 ???

Please revert asap.

Regards

Neeta

CAclubindia

CAclubindia