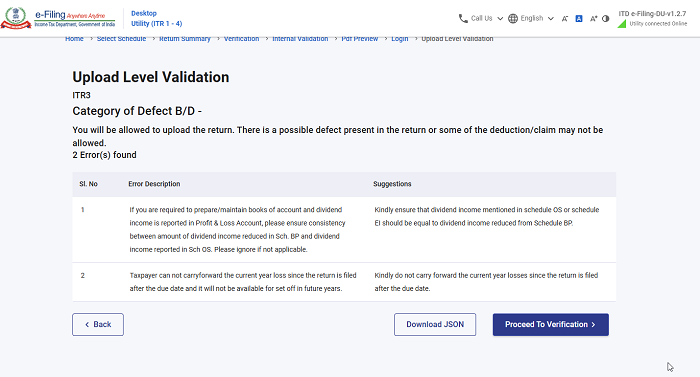

In ITR-3, for a belated return, Schedule CFL is not saving 0 as carry forward losses. In the validating page, it is showing that belated return cannot carry forward losses to futures years. That is understandable. But it just doesn't remember the input of zero as the amoount to carry forward!! What to do?

CAclubindia

CAclubindia