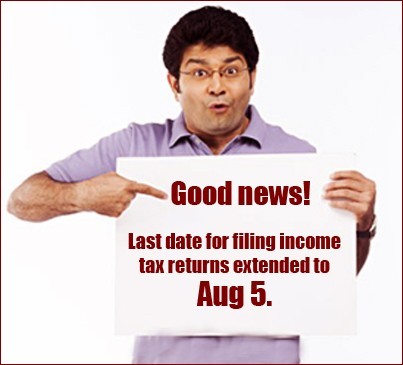

due date of income tax return filing for A.Y. 2013-14 Extended to 05 August 2013

Menu

Return filing date extended

Replies (11)

Recent Threads

- SPOM FOR CA FINAL

- Are AI tools like ChatGPT actually useful for CA w

- UK TAX (HMRC) HELP WITH INVESTIGATIONS, DISPUTES,

- Payment processor not transferring or refunding pa

- Form 16 format

- 17(5) Blocked ITC

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

Related Threads

CAclubindia

CAclubindia