Tax Consultant

1596 Points

Joined February 2009

How to submit Taxpayers response to intimation u/s 143(1)(a)(vi) for mismatch of income from 26AS Form-16 or 16A. CBDT circular giving manner of furnishing response

Sub-clause (vi) of clause (a) of sub-section {1) of section 143 of the Income-tax Act, 1961 (‘Act’) as introduced vide Finance Act, 2016, w.e .f. 01.04 .2017, while processing the return of income, prescribes that the total income or loss shall be computed after making adjustment for addition of income appearing in Form 26AS or Form 16A or Form 16 (Three TDS Forms) which has not been included in computing the total income in the return.

In this regard, CBDT has issued Instruction No.(s) 9/2017 dated 11.10.2017 & 10/2017 dated 15.11.2017 for identification of instances in which section 143(1)(a)(vi) of the Act may be invoked by CPC- ITR, Bangalore on the basis of information contained in the returns of income namely ITR Forms 1 to 6.

Since CPC-ITR,Bengaluru shall be shortly issuing the intimations proposing adjustments in identified returns under section 143(1)(a)(vi) of the Act , the CBDT has issued a circular no 01/2018 dated 10-01-2018 specifying the process to be followed by the taxpayers for filing the response to such intimations.

Since section 143(1}(a)(vi) is being applied for the first time while processing the returns, CBDT has been decided that before issuing an intimation of the proposed adjustment , initially an awareness campaign would be carried out to draw the attention of the taxpayer to such differences.

- This said campaign would be in form of an e-mail and SMS communication. to the concerned taxpayer informing him about the variation in the tax-return vis-a-vis the information available in the three TDS Forms.

- Taxpayers shall be requested to submit response to the variation within one month of receiving the communication electronically.

- In case the taxpayer does not respond within the available time-frame or the response is not satisfactory, a formal intimation u/s 143(1)(a)(vi) proposing adjustment to the returned income would be issued.

- In cases where no response is received from the taxpayer within thirty days of issue of such an intimation, the proposed adjustment shall be made to the returned income.

Therefore, the concerned taxpayer must files a prompt, time ly and satisfactory response to the awareness campaign or subsequent intimation proposing adjustment u/s 143{1)(a)(vi) of the Act.

The various scenario(s) for furnishing response:

(a) Where upon receiving the awareness message or formal intimation u/s 143(1)(a)(vi) of the Act, if the taxpayer fully agrees with the proposed adjustment , he is required to file a revised return in response .

(b) Where upon receiving the awareness message or formal intimation u/s 143(1)(a)(vi) of the Act, if the taxpayer partially agrees with the proposed adjustment, he is required to

(i) file a revised return for the part of the proposed adjustment with which he is in agreement &

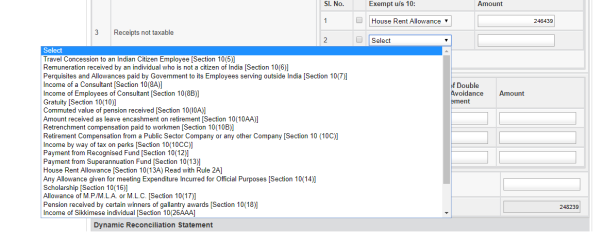

(ii) file a reconciliation statement (in the format to be provided by CPC-ITR on the e-filing site) for the part of the proposed adjustment with which he is not in agreement.

(c) Where upon receiving the awareness message or formal intimation u/s 143(1)(a)(vi) of the Act, the taxpayer disagrees with the proposed adjustment, he is required to file a reconciliation statement (in the format to be provided by CPC-ITR on the e-filing site) in support of his contention.

According to CBDT, based upon response of the taxpayer and the information available with the CPC-ITR, such returns shall be taken up for processing by CPC-ITR as per provisions of section(s) 143(1),143(1)(a)(vi) read with Instruction No.(s) 9/2017 dated 11.10.2017 & 10/2017 dated 15.11.2017

the following options.

the following options.

CAclubindia

CAclubindia