CA

208 Points

Joined August 2008

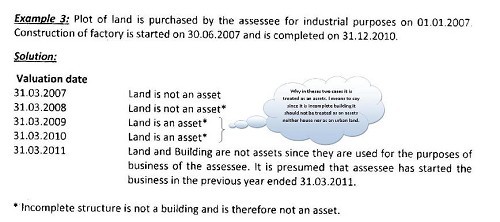

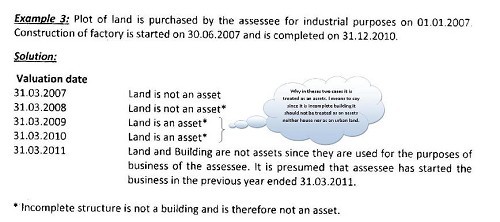

As per wealth tax unused land held for industrial purposes will not be treated as an asset for a period of 2 years from the date of acquisition. After expiry of 2 years it will be treated as an asset

so in your case for the valuation date 31.03.2007 & 2008 it will not be treated as asset but

it is assessable to wealth tax on valuation date 31.03.2009 since building is not completed it will be treated as land and i think there is printing mistake or above answer may be wrong.

on the valuation date 31.03.2010 it will be treated as building because as per because in wealth tax building or land appurtenant thereto is treated as building

but as per section 2(ea)(i)(3) building used for business or profession will not be treated as building hence will not be assessable :)