Menu

Query regarding buy back

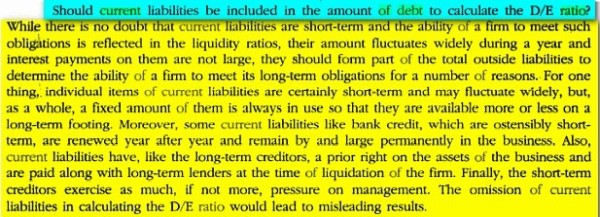

While checking if debt equity ratio is 2:1 after buy-back do we include current liabilities as well? In the suggested answer https://220.227.161.86/27518suggans_ipcc_may12-5.pdf (Q3a) current liabilities of Rs. 16,50,000 have been added in the numerator. Could anyone clarify this? TIA

Replies (4)

Recent Threads

- Company Formation for clothing business

- TDS on purchase 194Q

- Compensation for urban land acquisition

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

- Taxation for sale and purchase of REIT shares

- PAN - AADHAR LINK

- RECONCILIATION OF GSTR 2B Vs BOOKS WITH VBA

Related Threads

CAclubindia

CAclubindia