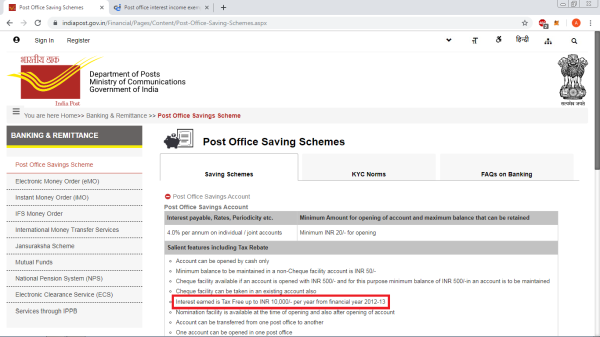

Is the post office interest income exempt upto Rs 3500 ? Also is it applicable with 80TTB 50,000 deduction?

I have one more doubt, in the Financial Year 2018-2019 there are two entries of Consolidated Interest Payment one on 1st April 2018 and other on 31st March 2019. It's same in both PPF and savings bank passbook. Earlier it was coming on 1st April of each year. So should I consider both in my ITR AY 2019-20 Return?

CAclubindia

CAclubindia