Menu

Penalty on late filing of excise return

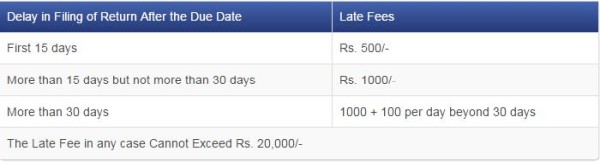

The Excise Return was filed within due date but the same was rejected. I scanned my X M L file for error but found none..came to know about the rejected return after 28 days and filed the return.

What can be the max penalty imposed on me?

Is there any way to solve this issue without paying any penalty?

Replies (11)

Recent Threads

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

- Seeking Clarity: New Transport Allowance Limits (D

- Query regarding Consolidated Gift Deed for Bank Tr

- TDS u/s194IB - Joint Ownership

- Free GST Reconciliation Tool in Google Sheets R

- NRI return after due date refund case

- TDS u/s 194J - training honorarium

Related Threads

CAclubindia

CAclubindia