| Originally posted by : SSG | ||

|

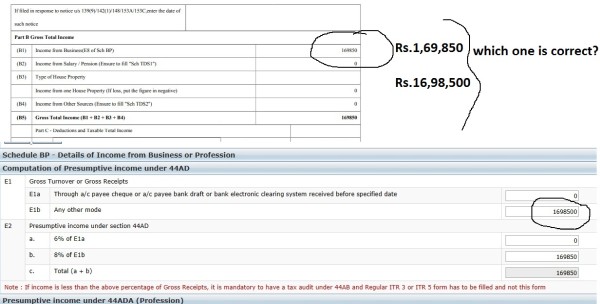

0607 - Other Profession Assessee has been filling ITR-4s earlier years and ITR-4 for AY 2017-18 for his income from insurance companies, on presumptive basis. |

|

that is not the correct treatment. Commission income cannout be filed as presumptive income

CAclubindia

CAclubindia