Hello All,

While filling ITR1 (original) for AY 2018-19, I forgot to mention the paid tax BSR code/Challan number under self-assessment tab of ITR form. Last week I got a notice from IT department 143(1) asking me to pay outstanding tax. That too within 30 days. As I mentioned earlier - I have already paid this tax in July 18, but forgot to mention details in ITR form. I Do have challan PDF with me for previous payment made.

What should I do now from below? My ITR is appearing as processed by department.

Options -

A) File revised return

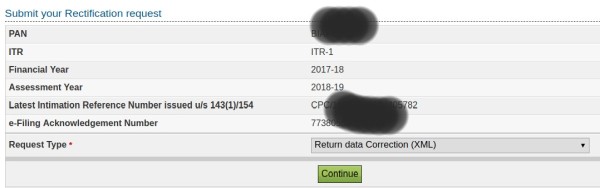

B) Sibmit rectification request - Using request type as - Return Data Correction (XML)

C) Respond to outstanding Tax demand -

- Choose Disagree with demand and then submit the existing copy of paid challan (using reasons as demand paid)

Please confirm.

CAclubindia

CAclubindia