can a non working person claim standard deduction of 40000?

Menu

Non working person and standard deduction

Replies (8)

Recent Threads

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

- 194a for A y 2024-25

- Compensation & Benefits

Related Threads

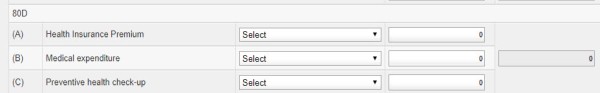

in (a) we fill the mediclaim, in (c) we fill the tests done...but what about (b) what can be filled there? plz guide

in (a) we fill the mediclaim, in (c) we fill the tests done...but what about (b) what can be filled there? plz guide CAclubindia

CAclubindia