Menu

Mistake in return

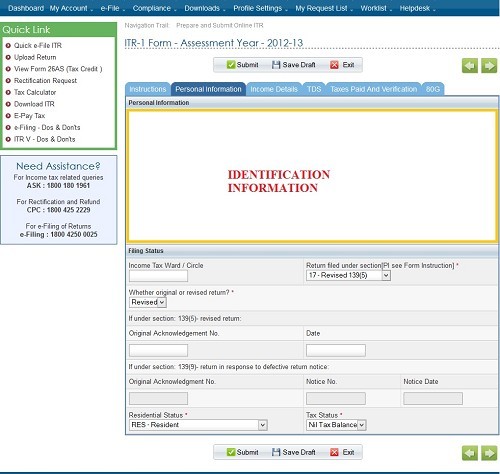

I have filed return for A/Y 2012-13 on 31st March 2014 as it was a nil return. I filled form 4S but by mistake I also entered salary and uploaded the return with tax payable. After the return was uploaded i came to know about my error. Now ITR-V is showing tax payable. I have not sent signed ITR-V to bangalore yet. Is there any remedy??

Will the return be cancelled if I don't send ITR-V??

Please reply it is urgent.

Replies (3)

Recent Threads

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

- GST RATE OF OUT DOOR CATERING

- Non resident taxation & income tax in India

- GST Rate for oral Hygiene Combo Pack

- GST registration - Address error

- TDS on property pu

- Import of goods IMS action related

- Incometax Survey - Updated Return Filing after the

- TCS under 206C(1F)

Related Threads

CAclubindia

CAclubindia