Experts,

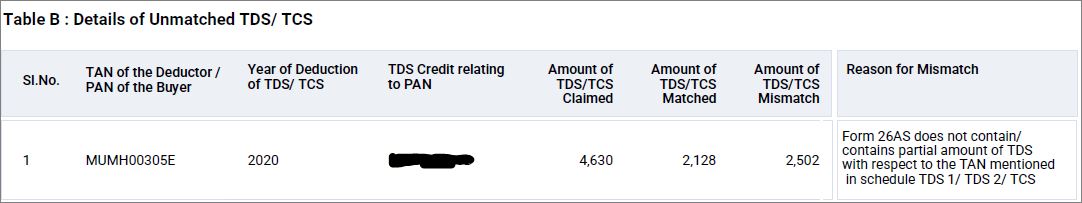

I recently received the intimation u/s 143(1) for AY 2021-22. In that there is a mismatch between tax credits claimed and allowed for TDS on interest u/s 194A due to which refund amount is lower than claimed in return. I rechecked the TDS amount in 26AS and it is matching with what I had submitted in the TDS schedule for that deductor. Attached screenshot for reference.

What are the options available to me in this case since the TDS credit has been wrongly disallowed in the assessment leading to lower refund?

Regards,

Manas Phadke

CAclubindia

CAclubindia