Chartered Accountant

1375 Points

Joined August 2012

I agree with above opinions. I also add:

I. Deduction for Interest on Home-Loan u/s 24(b):

Self-occupied Property - Maximum deduction = Rs. 2,00,000

Let-out property or Rented House - maximum Deduction - NO LIMIT

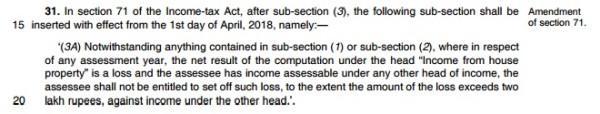

In your case, current year loss under head House property can be set off against other heads and the balance loss, if any shall be carried forward. However, in subsequent years, such carried forward losses can be set-off only against the respective heads.

II. You had also mentioned:

"For example, Directors draws handsome amt of remuneration frm company. If it can be set off against any income head than introduction of this section have no use."

Only current year losses under Head House Property is allowed to be set-off under any head. Once it is carried forward to subsequent years, then set-off is allowed only against respective heads. If you come to think of it, all these provisions are meaningful when put together.

III. Anyway, Nobody can benefit from these sections forever. The loan will eventually be repaid and the interest payments will stop and finally the residual carried forward losses shall lapse in some future year. The benefit ends there.

CAclubindia

CAclubindia