B.Com

25 Points

Joined August 2014

| Originally posted by : Tribhuvan Aditya Singh |

|

according to me you should incorporate LLP as it is easier & cheaper to incorporate and also very less compliances have to be followed as compared to pvt. ltd co. |

|

Thanks Tribhuvan,

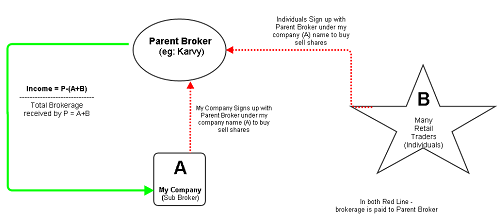

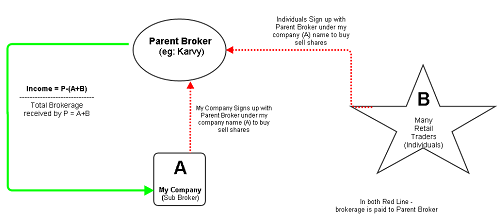

The CA I met he wanted me to register for Pvt. Ltd. Company. The reason could be that he is looking for his benefit for yearly audits and monthly involvements. The business model example I have attached in an image.

I am looking for least compliance. Also let me know if I open an LLP, can I employ people. If yes, can I adjust the salaries, rent, bills, etc against total revenue to extract net taxable income. Also can I show my family memebers as employees drawing salaries.

Many Thanks, John.

CAclubindia

CAclubindia