I want to file ITR4 to get benefit of 44AD / 44ADA / 44AE as I'm freelance software engineer working for companies outside India and my income is less than 50 lakhs.

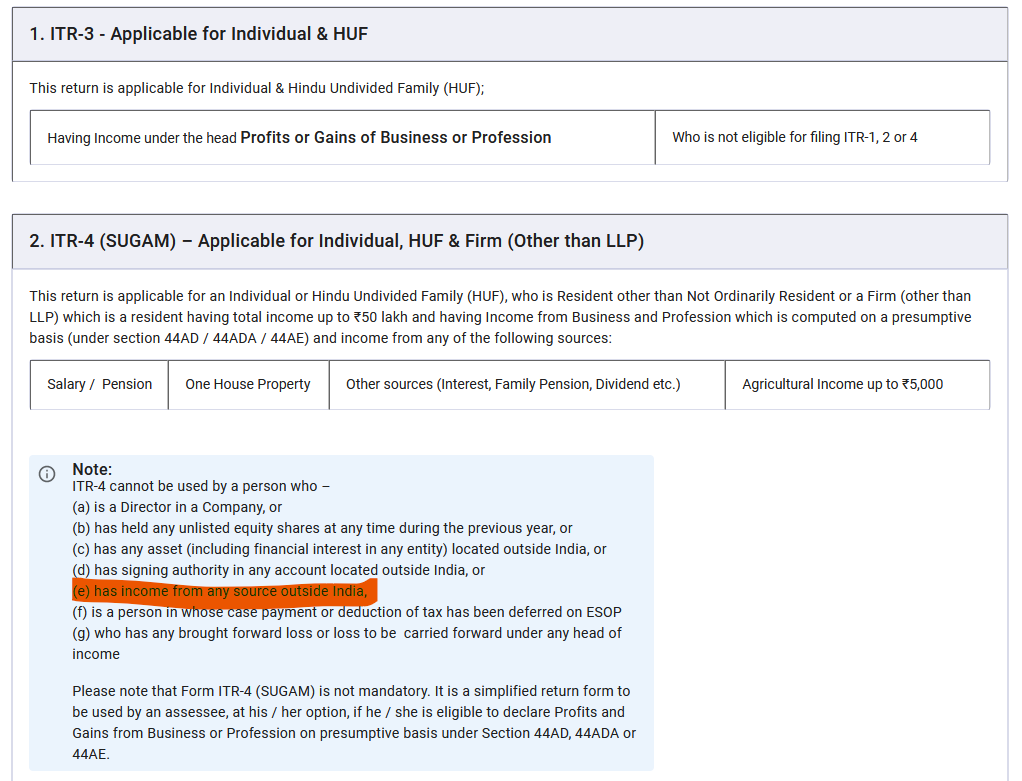

But on incometax portal it says If my income source is from outside India I can't file ITR4.

https://www.incometax.gov.in/iec/foportal/help/individual-business-profession#returnsandforms

"ITR-4 cannot be used by a person who –

(e) has income from any source outside India"

Does this line mean if I physically went to other country to work then I can't file ITR4 or it applies to freelancers working for foreign companies as well?

Thanks for reading, please guide me as I'm new and need to file ITR soon.

CAclubindia

CAclubindia