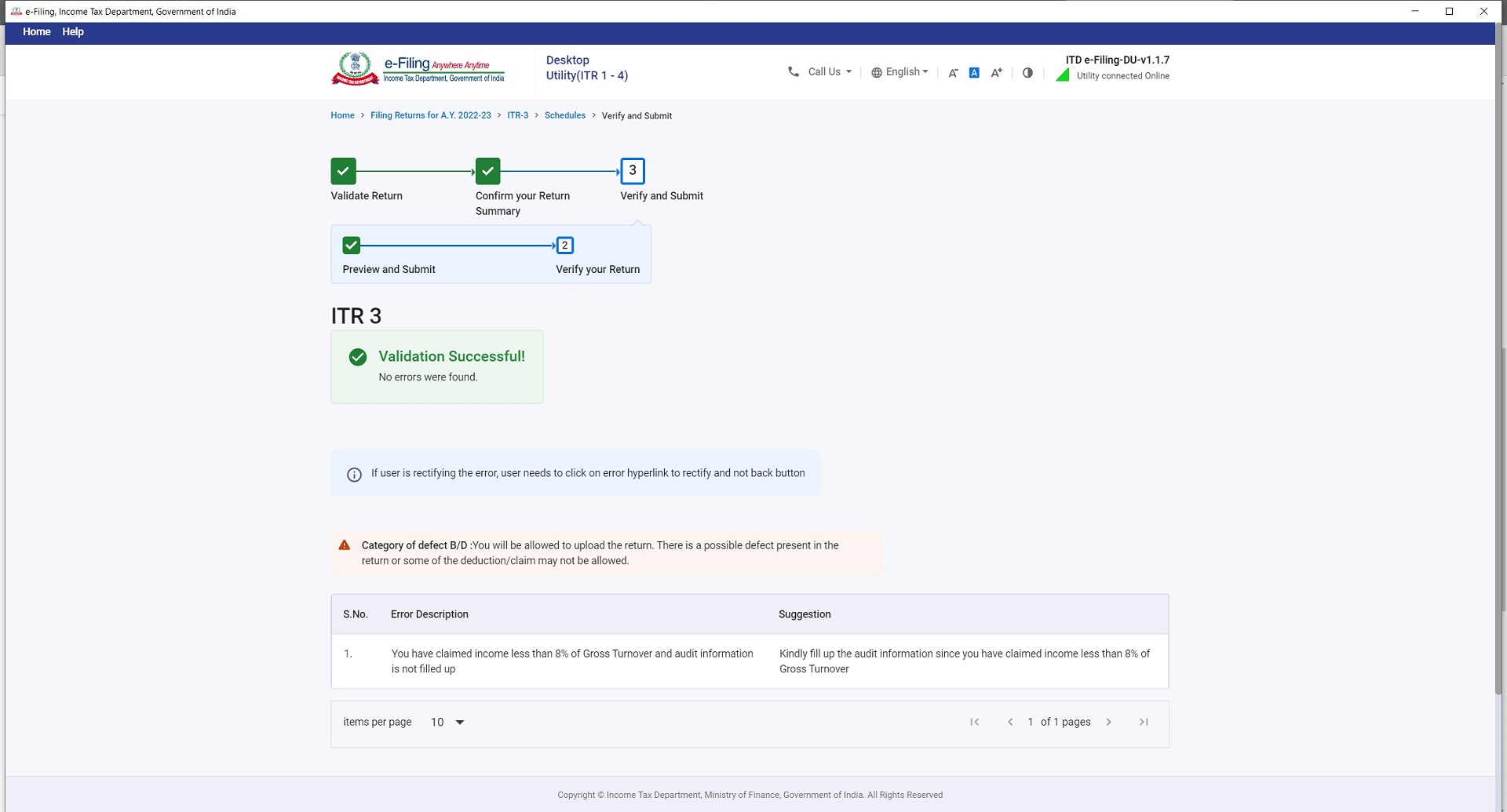

I am getting following error after validation successful in ITR 3

Category of defect B/D :You will be allowed to upload the return. There is a possible defect present in the return or some of the deduction/claim may not be allowed.

Error Descripttion Suggestion

1. You have claimed income less than 8% of Gross Turnover and audit information is not filled up Kindly fill up the audit information since you have claimed income less than 8% of Gross Turnover

Income Details

Business Stock Trading

Turnover 33 lakhs

Profit 60,000

LTCG (Shares) 8,000

STCG (Other Assets) 1.25 Lakhs

Exempt Income 20,000

Total Income 2.13 Lakhs

Taxable Income 1.93 Lakhs

If income is lower than taxable limit of 2.5 lakhs, audit clause u/s 44AB or 44AD is not applicable. I don't even have liability to file ITR, audit is also not applicable. But wanted to do so to avoid any notice from ITO later on.

Any thoughts on this are welcome.

CAclubindia

CAclubindia