Hi all

I was working in Chennai between 2006-2010, and filed tax under Chennai Circle. I left Chennai in 2010

In 2011-Nov I got a communication from CPC (H1), notifying a tax demand of ~ Rs 66000/- from AY2008-09. Unfortunately I missed this communication as I changed address.

For AY2011-12, I claimed a tax refund of ~ Rs 25000/-

In 2012-Mar I got a communication from CPC (143(1)), notifying me that the AY2011-12 refund of Rs 25000/- has been adjusted against the AY2008-09 claim. (The AY2008-09 outstanding demand stands at Rs 41000/-)

My AY2011-12 return was transfered from CPC to Chennai Circle AO

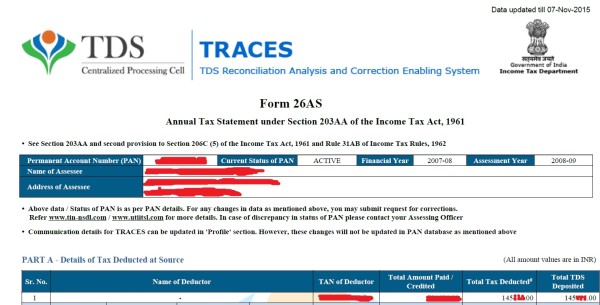

On checking the Form 26AS for AY2008-09, I found, it is missing the tax deposited for month May, Jun, Jul 2007, totaling ~ Rs 51000/- (Total TDS ~ Rs 192K, 26AS shows ~ Rs 145K)

It was not possible for me to go to Chennai and meet the Chennai Circle AO. So I have sent letters twice trying to inform them of the TDS not accounted for AY2008-09.

I have also responded to the Tax demand on the e-Filing site. But nothing happened.

How should I resolve this?

Thanks,

CAclubindia

CAclubindia