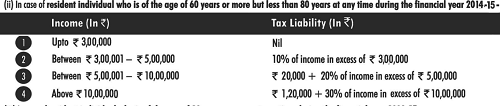

My Mother, who is 60 year of age is getting Family Pension Rs 35000/- pm after the death of my father. Bank is not dedicting TDS on it as its a family pension. My query is how much is the Tax liability on this amount after all standared deductions. Kindly compute through some example.

Menu

Income tax on family pension

Replies (8)

Recent Threads

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

Related Threads

CAclubindia

CAclubindia