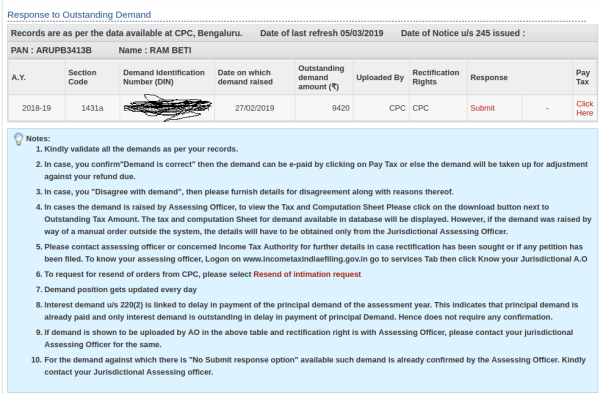

I have received a demand as shown in the image below.

But I did not receive any notice or any explanation about the demand either electronically or postal. There is nothing under e-proceeding as well. What to do , Please suggest.

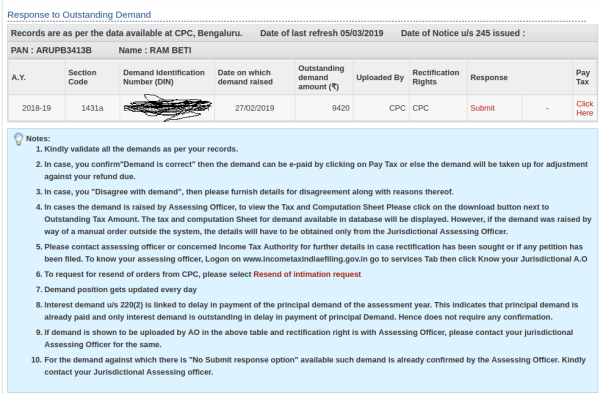

I have received a demand as shown in the image below.

But I did not receive any notice or any explanation about the demand either electronically or postal. There is nothing under e-proceeding as well. What to do , Please suggest.