Hello,

I have taken a home loan for ready built house which is in a different city from my current residing city.My Employer told me that i have to declare the property as "Let out". When i asked them that how can i declare the rental income(mandatory field for "let out" properties) while my parents are living in that property and i am not gaining any rental income from that property.There response was as follows:-

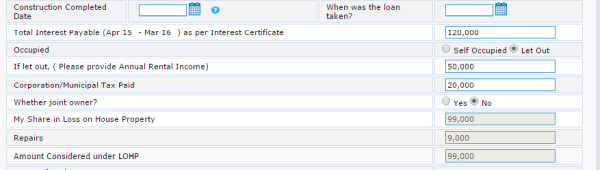

"Yes, even if your parents were living in the property you need to mention as let out property and claim the LOHP tax exemption. You need to provide the notarial rent value of Rs.50k in order to claim the exemption."

You can check the exemption calculation in the below image file in case i consider my property as let out.

As i am not earning anything from rental why i should declare 50k as rental income. Please guide me on this.

Thanks,

Manish

CAclubindia

CAclubindia