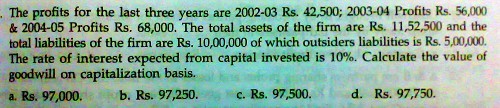

1-First you calculate Avg. profits-

Avg. Profit = 42500+56000+68000/3

= INR 55500

2-Then calculate Avg . capital employed-

Avg Capital employed = Avg. profit/ Normal rate of return

= 55500/10%

= INR 555000

3- Now calculate actual capital employed-

This is possible by the info given as per B/s . It says total assets is INR 1152500 and you know that balance sheet tallies on both sides so Total liabilities will be also INR 1152500....

Now since we need actual cap. employed ... we can get it by Subtracting outsiders liabilties from Total liabilties .. i.e 1152500- 500000 which will be INR 652500...

Now one question will be arising in your mind that why i have not subtracted only 10lakhs...???? There may be more question but reason for all those questions is that capital employed comprises of owners fund( this includes some reserves also) So in this question we need to calculate actual cap. employed which is nothing but Owners fund... thats why i have subtracted outsiders liabilty from total liabilty to get owners fund or actual capital employed..

4- Calculation of Goodwill-

Goodwill = Actual capital employed - Avg. capital employed

= 652500 - 555000

= INR 97500

Hope you have understood... If not ask me again without any hesitation

Can't get textbook answer.....Pls help.....Also from the same unit - 'Treatment of Goodwill in Partnership Accounts' (CPT)

Can't get textbook answer.....Pls help.....Also from the same unit - 'Treatment of Goodwill in Partnership Accounts' (CPT)