Hi All,

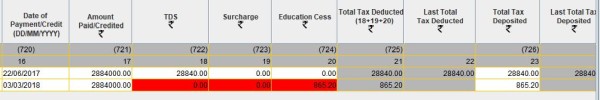

I have received a short deduction on my TDS return filed earlier of Rs 865.20, which i have already paid with a challan 281. But now when I am trying to update the returns for adding this challan there are errors in the RPU utility as below

The first line is for the original return filed in which the my CA did not pay the education cess so there are defaults.

How do I corrrect this for the newly paid amount?

CAclubindia

CAclubindia