What information should i fill in "Financial particulars of the business" in itr4

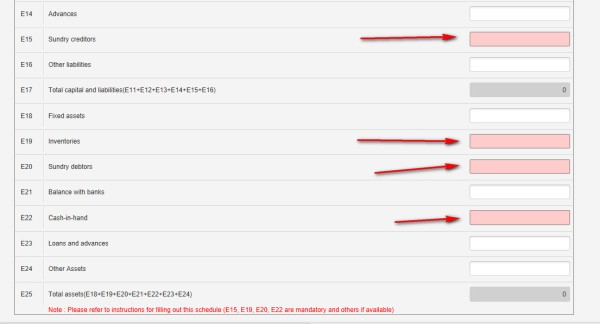

I dont have any data for those fields (E15 , E19, E 20, E22) and it is mandatory to fill those fields in latest itr it gives error when clicked on submit.

Please give your advice.

CAclubindia

CAclubindia