We have entered value of purchases instead of Tax (ITC) in col. IGST credit in GSTR3B return of July 2017.

How we can re-adjust/reverse the excess credit.

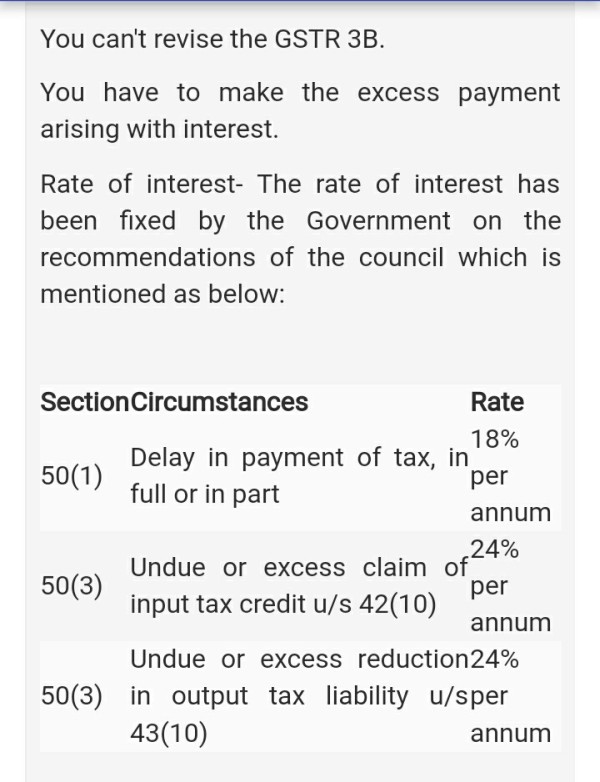

There is no option to re-open the return after the filed option exercised.

Menu

excess ITC taken in GSTR3B in July. How to reverse.

Replies (2)

Recent Threads

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

Related Threads

CAclubindia

CAclubindia