my queries are

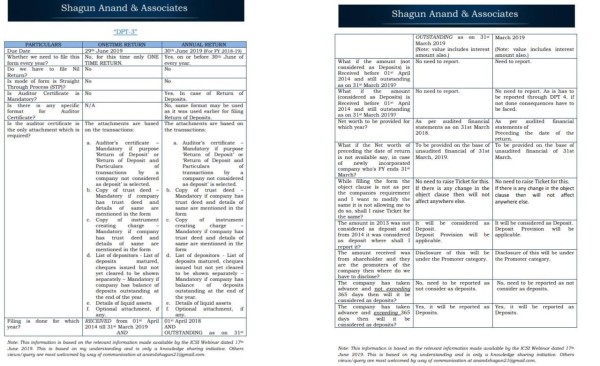

1. Whether NIL DPT 3 is mandatory?

2. Subsidy received from government (CG/SG) which is non refundable is required to be mentioned in DPT 3 or not

3. can auditor certificare be issued by only Statutory auditor or by any CA for the DPT 3 form..

Menu

DPT 3 Form

Replies (2)

Recent Threads

- Understanding section 269st

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

- Taxation for sale and purchase of REIT shares

- PAN - AADHAR LINK

- RECONCILIATION OF GSTR 2B Vs BOOKS WITH VBA

- Regarding cancellation of GST Number

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

Related Threads

of auditor in all rules and Act means statutory auditor.

of auditor in all rules and Act means statutory auditor.

CAclubindia

CAclubindia