Do we have to match the values of "total capital and liabilities" with "total assets" in itr 4. Do they have to be the same when calculating?

According to this youtube video it says that both the values needs to match.

https://youtu.be/Qo4L9jzrAnc?list=WL&t=1155

I came accross 2 other videos that said the same thing.

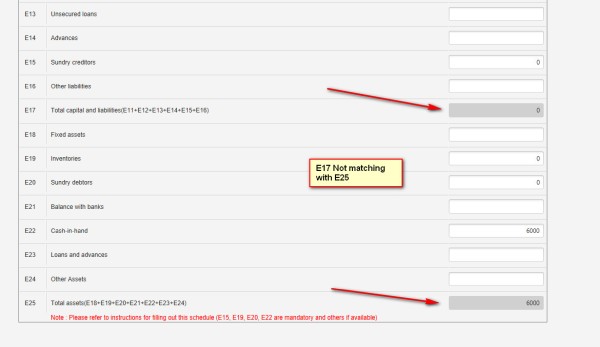

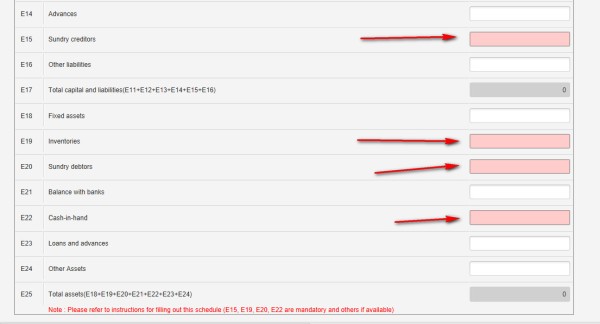

For example i have cash in hand 6000, and i put other mandatory fields as 0

Now after calculation

Total capital and liabilities = 0

Total assets = 6000

There is a mismatch.

Will there be any chance of receiving a defective notice due to this mismatch?

CAclubindia

CAclubindia