Article

1127 Points

Joined December 2014

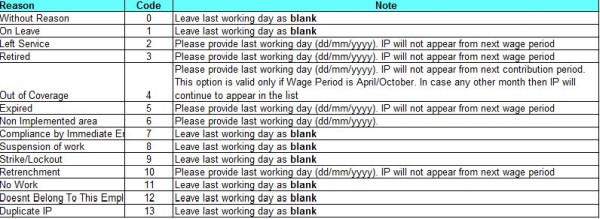

What is the meaning of AutoExit-

1)Can we remove an employee during a contribution period.(April-Sep & Oct-Mar)./by beging of a contribution period -April/October.

2)What are the procedure to remove an employee from ESI.

Say Gross pay of an employee exceeds Rs.15,000 during the month October ,i.e begining of a new contribution period.

I.e during Nov while paying Esi ,can we show salary exceeding Rs.15,000 in esi template & code as 4.Does it means no employee & company contribution is required during the month Nov.

3)what if we show salary as 15k during oct instead of such excess salary,so that employee can enjoy esi benefits, is it an non compliance of Act

4)What are consequences/effects when an employee is removed from esi/is there any special procedure to be followed by company to remove esi membership other than this esi template upload for challan generation.

5)If gross pay of an employee is Rs.14,000 & company paid Rs.4000 as festival bonus,is company liable to contribute/deduct on Rs.14k+4K=18K.

CAclubindia

CAclubindia