CA-Final

1485 Points

Joined May 2012

Thanks for such a good answer but I still have some confusions ...

I know what I am going to ask now may not be practically possible but for clearity I am asking this question...

Suppose in above Situation Unrealised Rent is 3,60,000.

Solution :

1. Expected Rent = 3,00,000 and Actual Rent = 3,60,000 - 3,60,000 = Nil

2. GAV = 3,00,000

3. Income from HP = 2,10,000 [ GAV - SD @ 30% ]

My Confusions :

1. In this Case Actual Rent received is Nil But Still he has to pay Tax ... Why ???

2. If we are recieving deduction of 1,20,000 or 3,60,000 , our taxable income is same... there is no benefit of more or less deductions ?

Opinion of CA Dr. Girish Ahuja Sir :

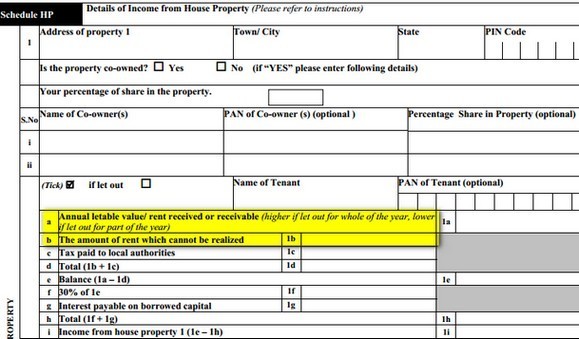

According to him , there is another provision in "Return of Income Tax" under which we can deduct Unrealised Rent from GAV and not from Actual Rent to get more appropriate and good answer.

( is it true ?)

Solution according to him :

If Unrealised Rent is 1,20,000

1. Expected Rent = 3,00,000 and Actual Rent = 3,60,000

2. GAV = 3,60,000

3. NAV = 2,40,000 (GAV - Unrealised Rent i.e.3,60,000 - 1,20,000)

If Unrealised Rent is 3,60,000

1. Expected Rent - 3,00,000 and Actual Rent = 3,60,000 (Assuming No Unrealised Rent)

2. GAV = 3,60,000

3. NAV = Nil (GAV - Unrealised Rent i.e. 3,60,000 - 1,20,000)

Please tell me which approach to follow or not to follow or any other suggestion ???

CAclubindia

CAclubindia