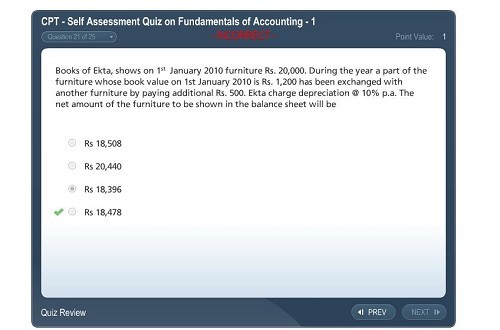

please tell me how we will get Rs 18478

Menu

Forum Search

Depreciation

Any question Join us on facebook and our experts will help you.

First tell me how did you choose 18,396.

They have stated that the fixed assets were "sold during the year" hence you will have to assume that it will charged at 5% (10% * 1/2 Year). You will get the answer 18475/- dont know how it is 18,478

Any question Join us on facebook and our experts will help you.

YES,,, Praveen sir is right,, answer must be 18475,, if we assume that transaction took place on 30th june (i.e. 6 mmonths),,

20000*10%*6/12 + 20500*10%*6/12 = 2025

VALUE OF FUR. = 20500-2025= 18475...

Let us assume that the furniture was sold on june 30. till then depreciation for furniture exchanged is is 1200*(0.05) = 60 so value of the furniture is 1140 now this is exchanged for another furniture and 500 is paid more. so book value of the new furniture is 1140+500 = 1640 (assuming no losses on the exchange of furniture) now the book value of the furniture which was with the firm through out the year is (20,000 - 1200)*0.9 = 18800*0.9 = 16920. now the new furniture which is added on june 30th will be depreciated at 5% so book value is 1640*0.95 = 1558. so total book value is 18478. The mistake with the previous answer is they forgot to take into the bookvalue of furniture on june 30th the depreciation on the old asset.

Yes,,, now i got my mistake,, luks lyk i need to study CPT again......

i dont understand 0.9 and 0.95.pl explain

The depreciation uses written down value method. if depreciation is 10% for 20,000 then depreciation is 10%*20000 = 2000 so remaining book value is 20,000 - 2000 = 18000 we can directly do it by 20,000(1 - 10%) = 20,000(1 - 0.1) = 20,000(0.9)

similarly if the depreciation is 5% then we multiply by (1- 5% ) i.e. (1 - 0.05) = (0.95)

Hi everybody, the answer given by anshul is absolutely right. In the question, the time of selling the furniture is not given so you need to check all the three possibilities : it is sold in the beginning of the year OR it is sold in the middle of the year OR it is sold at the year end. Only one assumption must have been made in the question. let us check the possibilities :

1st possibility : it is sold in the beginning of the year :

Dep on opening balance remaining till end (20,000 - 1,200) * 10% = 1,880

Dep on furniture sold (no dep as sold in the beginning) = NIL

Dep on furniture purchased (full year ) (1,200 + 500) * 10% = 170

Total dep = 2,050

closing balance of furniture (20,000 - 1200 + 1,700) - 2,050 =18,450

Since it is not there in the option, let us check 2nd possibility i.e. sold in the middle of the year :

Dep on opening balance remaining (20,000 - 1,200) = 1,880

Dep on furniture sold (1,200 * 10% * 6/12) = 60

Dep on new furniture purchased {(1,200 - 60) + 500} * 10% * 6/12 = 82

closing balance of existing furniture :

18,800 - 1,880 = 16,920

1,640 - 82 = 1,558

closing balance = 18,478

since this matches the given option, there is no need to check the third option. if u have any further doubt, revert back to me.

Regards,

CA Shakuntala Chhanagni

the answer given by anshul is not 18450 but 18475 and he assumed that the furniture is sold in the middle of the year.

Oh, by mistakenly I wrote Anshul instead of Tejaswi Kasturi. But anyway, answer is 18,478

Leave a Reply

Your are not logged in . Please login to post replies

Click here to Login / Register

Recent Threads

- 17(5) Blocked ITC

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

Related Threads

CAclubindia

CAclubindia