Hello Everyone,

I am a exporter of services ( a web developer). I export my services to foreign clients and get income in Dollars through paypal.

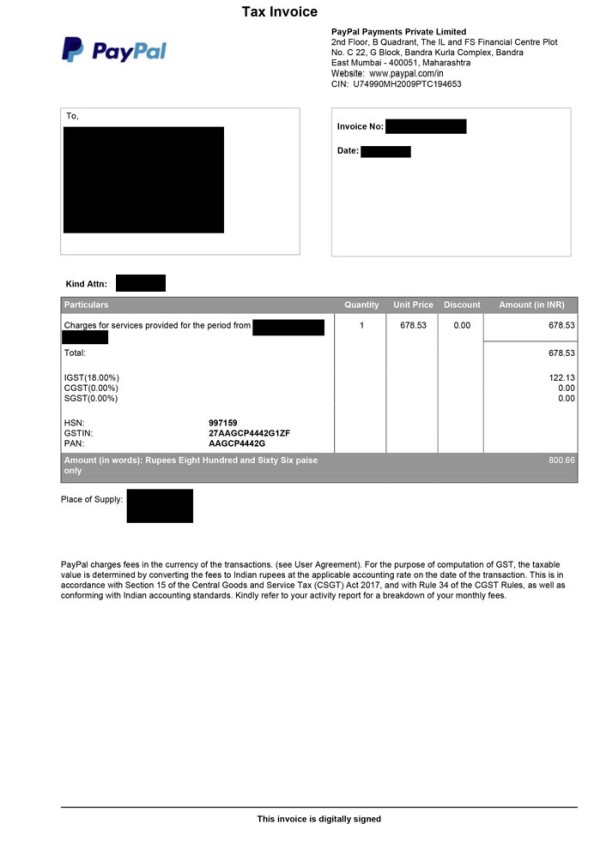

Paypal issues me invoice monthly a sample is given below:

This invoice is for services of paypal to me and it is paying IGST for it to Govt.

So, the question is, this invoice is for paypal services and it nothing to do with my export services, correct?

So, I need to fill GSTR 3b with payment at 18% of monthly earning? or what paypal paid is enough and I have to file nil return?

please help me.

thanks

CAclubindia

CAclubindia