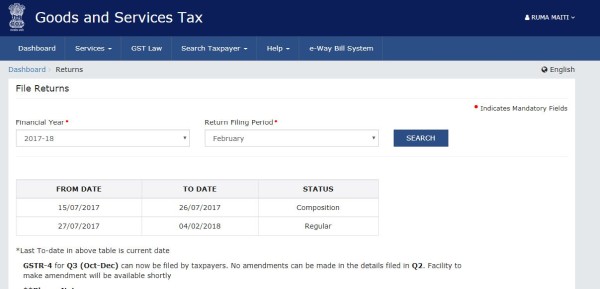

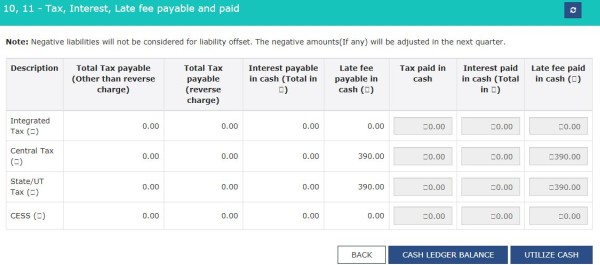

I had taken gst no as a composition scheme in 26/07/2017 , but in 27/07/2017 I changed the scheme into regular from composition . and I filled return also from that date in regular scheme . but the composition scheme till not change from 15/07/2017 to 26/07/2017

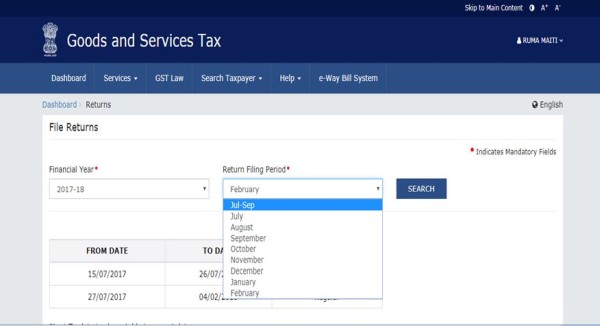

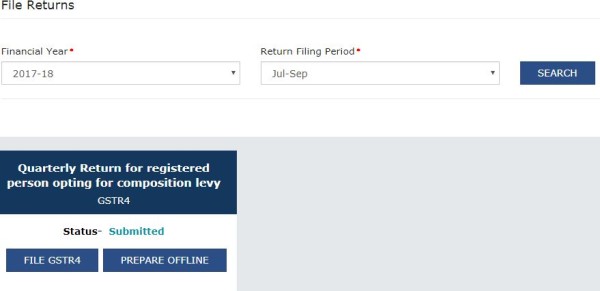

jul-sep return vornai hoga kaya sir please advise me urjent

Menu

Composition to regular

Replies (16)

Recent Threads

- CASH AS GIFT OR FD AS GIFT

- NPS Pre Maturity full exit taxation rules

- Planning to ceased a Business

- Taxation for sale and purchase of REIT shares

- PAN - AADHAR LINK

- RECONCILIATION OF GSTR 2B Vs BOOKS WITH VBA

- Regarding cancellation of GST Number

- GST on business receipts pre -registration

- A Restaurant registered under the Composition Sche

- GST RATE OF OUT DOOR CATERING

Related Threads

CAclubindia

CAclubindia