| Originally posted by : Subir Mukherjee | ||

|

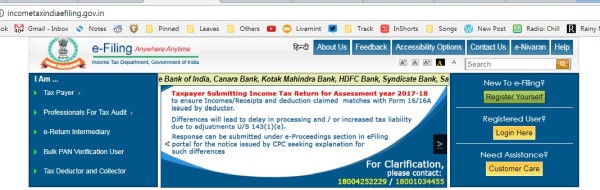

Hi, Even I have received the same letter. I had filed ITR1 since I am salaried and serving in private organisation. Within the Form 16 as received from my organisation. I have entered the Gross Income in my ITR1 form as per "Gross total income (6+7)" from my Form 16 form which is after deducting "Deductions u/s 24 - Interest" against housing loan which I had filed on 16th June 2017. Today, I received a soft copy from I Tax with Subject : "Communication of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961. It mentions to respond to the adjustments(s) proposed u/s. 143(1)(a) within 30 days. Also its mentioned that an revised return upload can be enabled to process with complete of data. Since there is NO provision for Deductions u/s 24 - Interest, can you guide me what is the suitable steps for me. Also I am facing the same problem there is No notice in the "e-assesment / procedding" section I would appreciate guidance on this please. |

|

I also got same letter for Home Loan interest is not taken into consideration for calculating mismatch amount

CAclubindia

CAclubindia