Finance/Compliance Consultant

60243 Points

Joined June 2010

Here is the correct GST treatment for ITC booked on 31-03-2025, shown in GSTR-3B Table 4(B)(2) – Others (Reversal) in March 2025, and reclaimed in April 2025.

I’ll explain why this is correct, how it should appear in GSTR-9, and what you must ensure for compliance.

✅ 1. What your entry means

March 2025 (Return for FY 2024–25)

You reversed ITC by reporting it in:

This means:

➡️ You did not claim this ITC in FY 2024-25.

April 2025 (FY 2025–26)

You reclaimed ITC by reporting it in:

This means:

➡️ ITC belongs to FY 2024-25 but was claimed in FY 2025-26.

This is permissible under Section 16, provided it is taken before the due date of GSTR-3B for September 2025 (or annual return, whichever is earlier).

🧾 2. How to show this in GSTR-9 for FY 2024–25

Since ITC was not availed in FY 2024-25, and you reversed it in March 2025:

You must report:

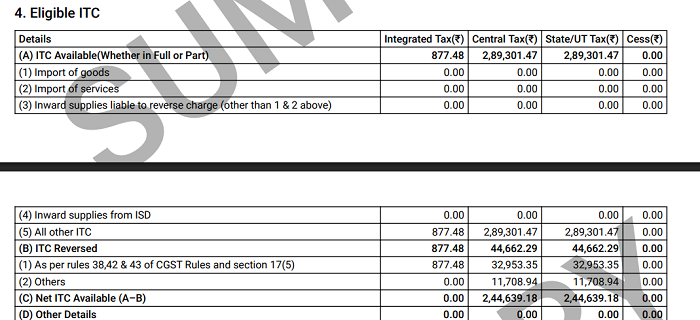

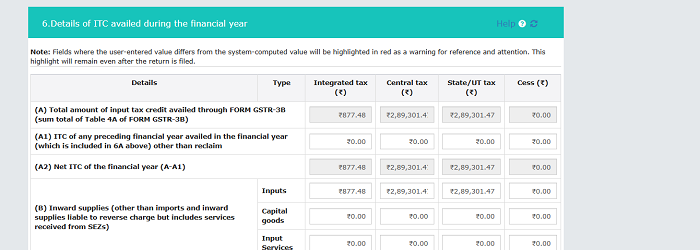

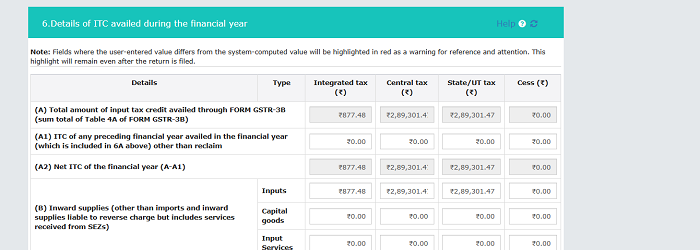

✔ Table 6 – ITC Availed

Do NOT show this ITC here because it was NOT availed during the year.

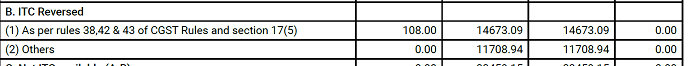

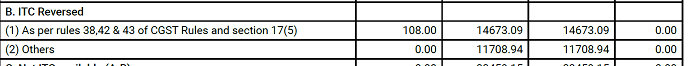

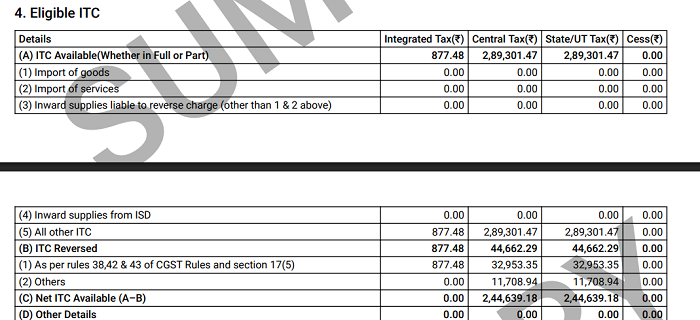

✔ Table 7 – ITC Reversed During the Year

Show the March reversal amount in:

This tells the department that you reversed this ITC and did not claim it in FY 2024-25.

✔ Table 13 – ITC Availed for Previous FY but taken in next FY

This is where April 2025 reclaim must be shown.

In Table 13, disclose:

➡️ “ITC relating to FY 2024–25 availed in GSTR-3B of FY 2025–26”

This is the most important part for compliance.

📌 3. How it will appear in GSTR-9C (if turnover > ₹5 crore)

The reconciliation must show:

Part IV – Reconciliation of Input Tax Credit

Auditor will report whether this is correctly adjusted and whether any interest is due (usually not required if reversal was shown properly in March).

⚠️ 4. VERY IMPORTANT

Because you reversed ITC in March and reclaimed in April, no interest is required, provided:

-

March return correctly showed reversal

-

April return reclaimed the exact amount

-

The goods/services were eligible for ITC

-

All conditions of Section 16(2) are fulfilled

If reversal was missed in March and reclaim happened incorrectly later, interest under Rule 88B may apply — but in your case, reversal was made → safe.

🎯 Final Summary for Quick Reference

March 2025

April 2025

GSTR-9 reporting

| Table |

What to Report |

| 7H |

ITC reversed in FY 24–25 (March) |

| 13 |

ITC of FY 24–25 claimed in FY 25–26 (April) |

| 6A / 6B / 6C |

Do NOT include this ITC |

GSTR-9C