CA Student

15932 Points

Joined May 2011

Accumulated PF balance payable to an employee is exempt u/s 10(12), subject to certain conditions, like continuous service of 5 years etc., whereas TDS u/s 192A will be deducted for premature withdrawal from the fund, i.e. service less than 5 years or not fulfilling other conditions for exemption.

Sec. 10(12): the accumulated balance due and becoming payable to an employee participating in a recognised provident fund, to the extent provided in rule 8 of Part A of the Fourth Schedule

Rule 8 of Part A of the Fourth Schedule: Exclusion from total income of accumulated balance.

.

The accumulated balance due and becoming payable to an employee participating in a recognised provident fund shall be excluded from the computation of his total income—

.

(i) if he has rendered continuous service with his employer for a period of five years or more, or

.

(ii) if, though he has not rendered such continuous service, the service has been terminated by reason of the employee's ill-health, or by the contraction or discontinuance of the employer's business or other cause beyond the control of the employee, or

.

(iii) if, on the cessation of his employment, the employee obtains employment with any other employer, to the extent the accumulated balance due and becoming payable to him is transferred to his individual account in any recognised provident fund maintained by such other employer.

.

Explanation.—Where the accumulated balance due and becoming payable to an employee participating in a recognised provident fund maintained by his employer includes any amount transferred from his individual account in any other recognised provident fund or funds maintained by his former employer or employers, then, in computing the period of continuous service for the purposes of clause (i) or clause (ii) the period or periods for which such employee rendered continuous service under his former employer or employers aforesaid shall be included.

Sec. 192A: Notwithstanding anything contained in this Act, the trustees of the Employees' Provident Fund Scheme, 1952, framed under section 5 of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952 (19 of 1952) or any person authorised under the scheme to make payment of accumulated balance due to employees, shall, in a case where the accumulated balance due to an employee participating in a recognised provident fund is includible in his total income owing to the provisions of rule 8 of Part A of the Fourth Schedule not being applicable, at the time of payment of the accumulated balance due to the employee, deduct income-tax thereon at the rate of ten per cent :

.

Provided that no deduction under this section shall be made where the amount of such payment or, as the case may be, the aggregate amount of such payment to the payee is less than thirty thousand rupees

.

Provided further that any person entitled to receive any amount on which tax is deductible under this section shall furnish his Permanent Account Number to the person responsible for deducting such tax, failing which tax shall be deducted at the maximum marginal rate.

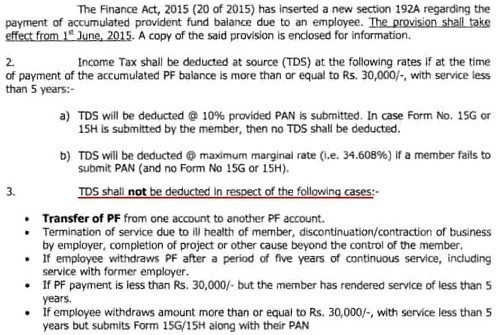

EPFO has issued a circular reg. instructions for deduction of TDS on withdrawal from PF w.e.f. 01.06.2015. Circular No. WSU/6(1)2011/IT/Vol-IV/5931, dated 21.05.2015. Relevant extract is given below:

.

CAclubindia

CAclubindia