Can exemption under section 54 & section 54GB both can be avail in a single gain transaction?

Menu

"dilemma" exemption under section 54 and 54 gb .

Replies (5)

Recent Threads

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

- Input tax credit on rent to rent

- Family Pension Army

- Waste Management services

Related Threads

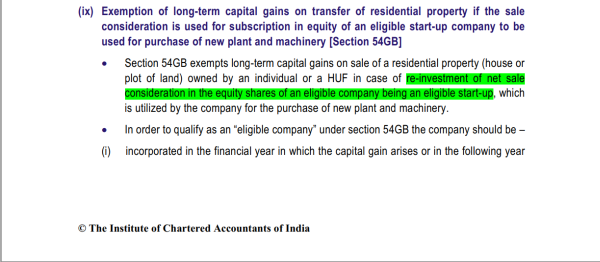

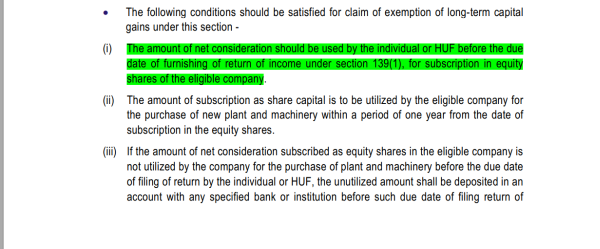

the law doesn't say any think clearly on this and in section 54GB its says that entire sales proceed is utilizing in buying equity share of a new co with money been used in purchasing new plant and machinery and unutilize funds is depoisted in CGAS account and must be used in 1 year time for the date of purchase share in the company.

the law doesn't say any think clearly on this and in section 54GB its says that entire sales proceed is utilizing in buying equity share of a new co with money been used in purchasing new plant and machinery and unutilize funds is depoisted in CGAS account and must be used in 1 year time for the date of purchase share in the company. CAclubindia

CAclubindia