CAclubindia News

Vivek Tankha Calls for CA Protection Act, Flags Big Four Dominance in India's Audit Sector

13 February 2026 at 09:27Congress MP Vivek K. Tankha demands a CA Protection Act in Parliament, citing privacy concerns, agency scrutiny, and the growing dominance of Deloitte, PwC, EY and KPMG in India's audit sector.

ICAI elects New Torchbearers for the year 2026-27

13 February 2026 at 09:06The 26th Council of ICAI has elected CA Prasanna Kumar D as its 74th President and CA Mangesh Pandurang Kinare as Vice-President for 2026-27.

Draft Income Tax Rules 2026: Rule 9 on Determination of Income for Non-Residents

13 February 2026 at 09:03Rule 9 of the Draft Income-tax Rules 2026 outlines how Assessing Officers can determine taxable income of non-residents when exact India-sourced income cannot be ascertained. Know the methods and implications.

Zero Coupon Bonds Under Draft IT Rules 2026

13 February 2026 at 08:59Rule 7 of the Draft Income-tax Rules, 2026 prescribes detailed guidelines for notification of zero coupon bonds by infrastructure entities and PSUs. Know eligibility, investment conditions, compliance timelines and government approval process.

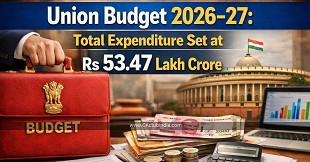

Union Budget 2026-27: Total Expenditure Set at Rs 53.47 Lakh Crore

12 February 2026 at 10:13Union Budget 2026-27 pegs total expenditure at Rs 53.47 lakh crore with capital expenditure of Rs 12.2 lakh crore and fiscal deficit target at 4.3% of GDP. FM Nirmala Sitharaman emphasizes growth with fiscal discipline.

New Quarterly TCS Filing Gets Revamp with Draft Form 143

12 February 2026 at 06:44CBDT releases Draft Form No. 143 for quarterly TCS statements under Section 397 of the Income-tax Act, 2025. Know applicability, reporting structure, collection codes and compliance requirements.

Draft IT Rules 2026: No Refund, No Interest & Higher TDS for Inoperative PAN

12 February 2026 at 06:44Rule 162 of the Draft Income Tax Rules, 2026, explains when PAN becomes inoperative for failure to link Aadhaar under Section 262(6). Know the impact on tax refunds, higher TDS/TCS rates, interest loss and the 30-day reactivation process.

Rule 160 Mandates Electronic Filing of Form 97 Declarations

12 February 2026 at 06:44Rule 160 of the Draft Income-tax Rules, 2026 prescribes the time limit, electronic filing procedure, verification requirements, and record retention norms for furnishing statements of Form No. 97 under Rule 159. Know who must comply and key due dates.

Form 140 and Form 144 Notified: Major Changes in Quarterly TDS Statements

12 February 2026 at 06:44CBDT introduces Form 140 for resident payments and Form 144 for non-resident payments under section 397. Read full details of quarterly TDS reporting, annexures, section codes, compliance impact and key changes.

CBDT Proposes New Quarterly TDS Reporting on Salary and Senior Citizen Income

12 February 2026 at 06:44CBDT has proposed Draft Form No. 138 for quarterly TDS statements under sections 392 and 393 covering salary and specified senior citizen income.

Popular News

- CBDT to Replace Forms 3CA, 3CB & 3CD with Consolidated Form 26

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- CBDT Proposes New Form 130 for TDS on Salary, Pension and Interest Income Under IT Act

- Draft Income Tax Forms 2026 Released: Category-wise Table of 190 Draft Forms Explained

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia