CAclubindia News

ICAI opens Provisional Registration for Class XII Studying Students to appear in May/June 2021 Foundation Exam

26 December 2020 at 10:22The Institute of Chartered Accountants of India has opened the Provisional Registration for Class XII Studying Students to appear in May/June 2021 Foundation Exam.

ICAI releases Exposure Draft of Amendments to Ind AS 117 - Insurance Contracts

26 December 2020 at 10:22ICAI has released the Exposure Draft of Amendments to Ind AS 117 - Insurance Contracts for public comments. Comments on the above-mentioned Exposure Draft may be submitted before January 24, 2021.

7,63,832 ITRs for AY 2020-21 have been filed on 25th December up to 9 PM

26 December 2020 at 10:22The Income Tax Department, via their official Twitter Handle has released the daily statistics of Income Tax Returns Filed. The due date for filing Income Tax Return for AY 19-20 is 31st December 2020.

ICAI releases 4 new handbooks on GST - Downloadable Latest Editions

24 December 2020 at 10:20The Institute of Chartered Accountants of India has released Four New Handbooks on GST which talks about Practical FAQs, Finalisation of Accounts, Liability to Pay in Certain Cases, and Returns and Payments under GST.

CBIC releases "Myths v. Facts" on CGST Notification issued on 22.12.2020 to curb GST Fake invoice frauds

24 December 2020 at 10:10CBIC releases "Myths v. Facts" on CGST Notification issued on 22.12.2020 to curb GST Fake invoice frauds

ICAI - Digi-Locker for ICAI Members and Students

24 December 2020 at 09:57The Institute of Chartered Accountants of India has successfully launched the Digi-Locker facility for its members and students during the recently concluded Virtual International Conference.

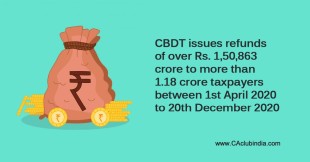

CBDT issues refunds of over Rs. 1,50,863 crore to more than 1.18 crore taxpayers between 1st April 2020 to 20th December 2020

23 December 2020 at 19:33Income tax refunds of Rs. 47,608 crore have been issued in 1,16,07,299 cases & corporate tax refunds of Rs. 1,03,255 crore have been issued in 2,01,796 cases.

ICAI releases result of the online Examination of the Certificate Course on Forex and Treasury Management held on 7th & 8th Nov 2020

23 December 2020 at 19:33The Institute of Chartered Accountants of India has released the result of the online Examination of the Certificate Course on Forex and Treasury Management held on 7th & 8th November 2020.

FM Smt. Nirmala Sitharaman concludes pre-Budget meetings for forthcoming Union Budget 2021-22

23 December 2020 at 19:33FM Smt. Nirmala Sitharaman chaired the pre-budget consultation meetings for budget 2021-22 held in virtual mode from 14th to 23rd December, 2020. More than 170 invitees representing 9 stakeholder groups participated in 15 virtual meetings.

RBI Cautions against unauthorized Digital Lending Platforms/Mobile Apps

23 December 2020 at 16:01Reserve Bank has also mandated that digital lending platforms which are used on behalf of Banks and NBFCs should disclose name of the Bank(s) or NBFC(s) upfront to the customers.

Popular News

- GST Council Urged to Scrap Rs 7500 Threshold and Fix Single 5% Tax Across Hotels

- Budget 2026-27: Direct Tax Reforms for Ease of Living, Small Taxpayer Relief

- TDS/TCS Guidelines to Become Binding on Tax Authorities and Deductors from April 2026

- Key Features of Union Budget 2026-27

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia