CAclubindia News

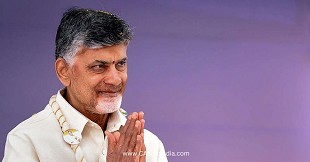

Former CM Chandrababu Naidu Gets Rs 118 Crore IT Notice

02 September 2023 at 08:53The Income Tax department has taken a significant step by issuing a show-cause notice to N. Chandrababu Naidu, the former Chief Minister and Telugu Desam supremo.

RBI Reports 93% Return Rate for Rs 2000 Notes in Circulation

02 September 2023 at 08:51As of August 31, 2023, 93% of the ₹2000 banknotes in circulation as on May 19, 2023, have been returned. The total value of the returned notes is ₹3.32 lakh crore

CBDT Introduces Form 71 for TDS Credit on Previously Reported Income in ITRs

02 September 2023 at 08:50CBDT notified Form 71 on August 30, 2023, to enable taxpayers to claim TDS credit for income that has been declared in their ITRs for a previous assessment year, but the TDS in a subsequent financial year.

CBDT releases the fifth annual APA report

02 September 2023 at 08:48CBDT records signing of 95 APAs in FY 2022-23, the highest ever in any financial year since the launch of the APA programme

August 2023 GST Collection Hits Rs 159069 Crore Mark, Registers 11% YoY Surge

02 September 2023 at 08:47₹1,59,069 crore gross GST revenue collected during August 2023; records 11% Year-on-Year growth

ICAI President on Institute's Role in Fostering Responsible Financial Reporting and Global Leadership

01 September 2023 at 08:53Let's have a look at some of the significant developments that took place since our last communication

GSTN releases Advisory on Reporting of ITC Reversal Opening Balance

01 September 2023 at 08:51GSTN has issued an important advisory on reporting of ITC reversal opening balance.

GSTN introduces a new ledger named Electronic Credit and Re-claimed Statement

01 September 2023 at 08:50Introducing Electronic Credit Reversal and Re-claimed statement on GSTN

FirstCry Founder Under Investigation for Suspected $50 Million Tax Evasion

31 August 2023 at 08:55The Income Tax department of India is probing an alleged tax evasion of $50 million by Supam Maheshwari, the founder of FirstCry, an online retailer of baby and child products.

PNB Launches GST Sahay App for Invoice-based MSME Loans up to Rs 2 Lakh

31 August 2023 at 08:55Punjab National Bank (PNB) launches the PNB GST Sahay App for MSME borrowers to access loans digitally using GST invoices.

Popular News

- Income Tax Rules, 2026 Notified: Rule-Wise Comparison with Old IT Rules, 1962

- Draft Income Tax Rules, 2026 Released: Major Changes in Capital Gains, Perquisites and Non-Resident Taxation

- Budget 2026-27: Direct Tax Reforms for Ease of Living, Small Taxpayer Relief

- TDS/TCS Guidelines to Become Binding on Tax Authorities and Deductors from April 2026

- Key Features of Union Budget 2026-27

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia