Hello Experts,

While filing ITR for the AY 2012-2013 i had showed details from a Form 16 from my previous organization and it was AY 2011-12 form 16. I made a mistake entering details from this one along with the Form16 from my current employer (AY 2012-2013) .

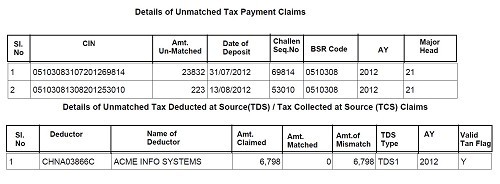

In 2013 june i have recieved INTIM A T I O N U / S 1 4 3 ( 1 ) O F T H E I N C O M E T A X A C T and it shows

Now my problems are ,

1)The Details from ACME INFO SYSTEMS actually i shouldnt have included in the ITR since it was from the previous assemenst year.

2) I paid Rs 23832+223 as Self Assesment Tax , and i think it wasnt required. :(.

3) In the intimation 143(1) it shows Total Interest Liability 234B+234C (1939+1069=3008) which i dont have any clue how this got accumulated.

Now how do i rectify this? I have read in income tax india web site that i cannot change my income details on a recitifcation , because it can get either rejected or delayed as follows.

"However, there should not be any revision in income figures or new claims since then the rectification request would be rejected or rectification would be delayed. It may be clearly noted that this facility is only for correcting mistakes apparent from record."

Please help!!

Regards

Anil

CAclubindia

CAclubindia