Menu

whether gst registration is mandatory in each state where property is rentet out?

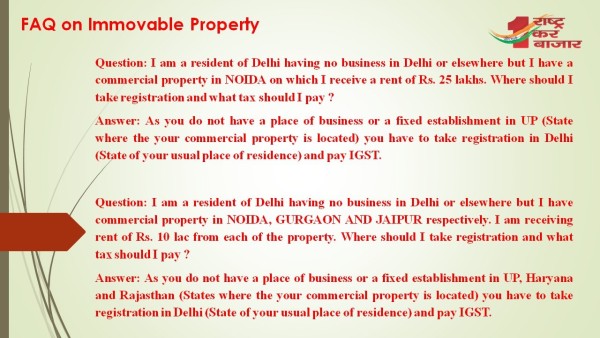

My client is an individual having property is 4 different state, but registered with up state. In every state rental > rs 20 laks. whether in every state where property is located needs gst registration. matter urgent.

Replies (6)

Recent Threads

- Form 16 format

- 17(5) Blocked ITC

- Transfer of equity shares to original owner

- Login credentials and payment acknowledgement not

- Export sales not realised payment not received fro

- Capital gain account amount utilisation

- Form 26QB – Section 194-IA: TDS on Full Cons

- Indexation Benefit available or not on Calculation

- Documents for return exhibition material

- Can I set off equity losses(both short term loss a

Related Threads

CAclubindia

CAclubindia