Finance/Compliance Consultant

60165 Points

Joined June 2010

Hey Sam,

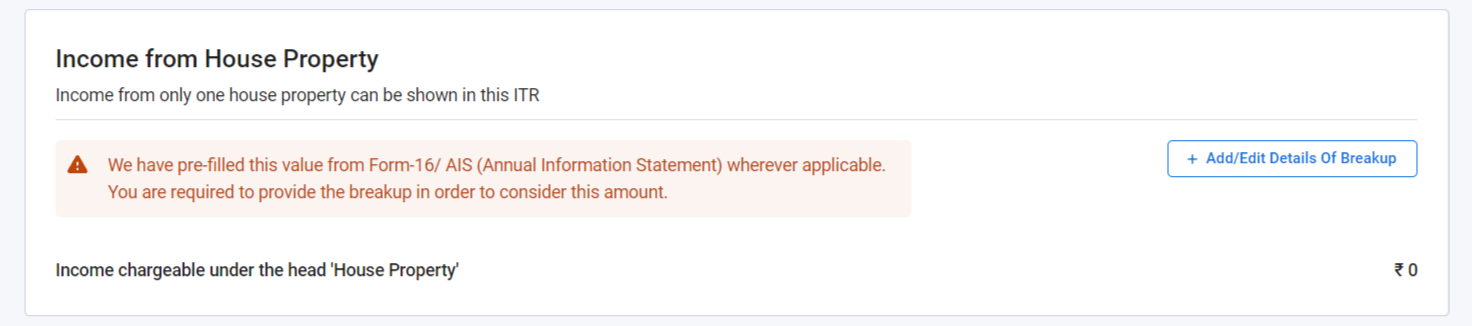

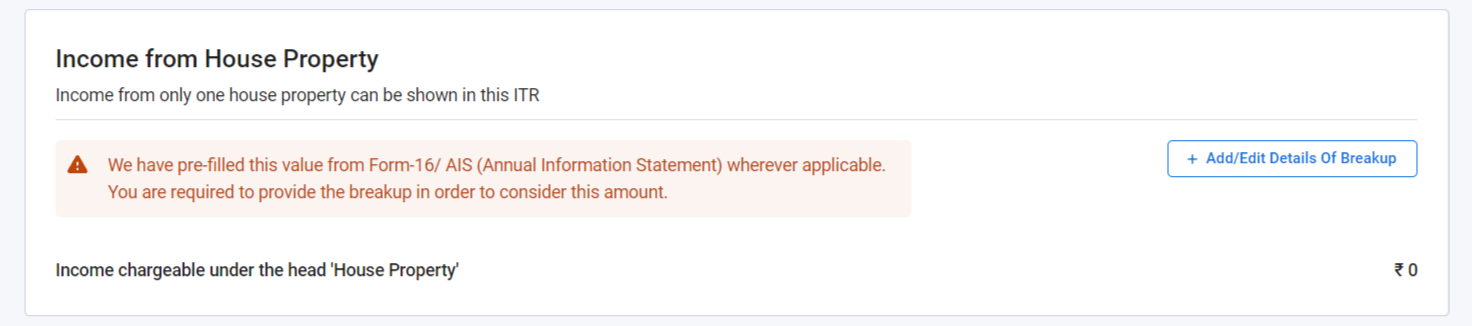

That message — "We have pre-filled this value from Form-16/AIS wherever applicable" — is just an info prompt from the Income Tax e-filing portal. It means the system has automatically fetched certain income or tax details reported by your employer (Form 16) or from the Annual Information Statement (AIS) filed by third parties (banks, etc.).

Why are you seeing it if you have only business income and no salary?

-

Possible reasons:

-

There might be some pre-filled income details in your ITR form from AIS or Form 16 linked to your PAN (maybe interest income, dividend, or other reported income).

-

Sometimes, bank interest, dividends, or other income is pre-filled from AIS, even if you don’t have salary income.

-

The portal shows this message in all ITR forms wherever pre-filled data exists, as a generic note.

-

What should you do?

-

Review the pre-filled data carefully — check income under ‘Income from Other Sources’ or ‘Salary’ section.

-

If any pre-filled data is not applicable (like salary), you can delete or modify it manually before submitting.

-

If you have only business income, you don’t need to worry about Form 16 entries — just ensure business income details are correctly filled.

Summary

-

The message is standard and informational.

-

Check the fields pre-filled and correct if needed.

-

It won’t affect your filing if you ignore it, but review to avoid errors.