Hi Finance Experts

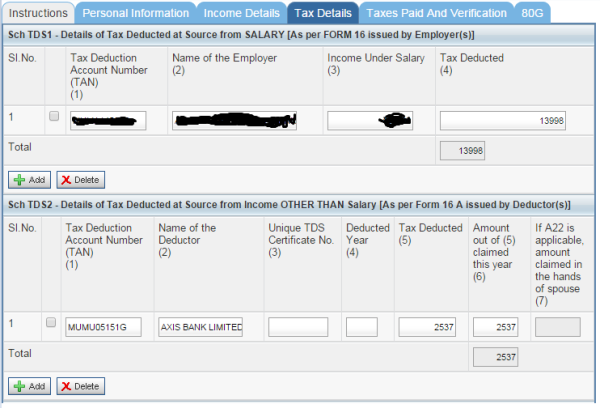

I am trying to file IT returns online in the official website https://incometaxindiaefiling.gov.in/. In the process of that under Tax Details tab I am not clear with the TDS income other than salary section. Below is the image for reference.

I know that the above TDS section is generated because I have had Short term Fixed Deposists in Axis Bank but I am not sure of this TDS deduction amount.

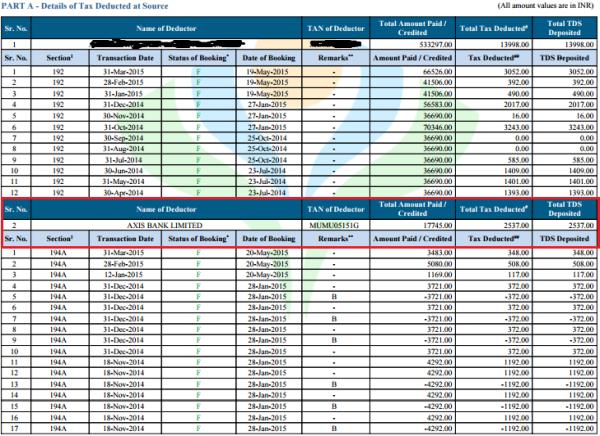

As shown in the above image, the tax deducted amount is auto generated, I haven't typed in anything there, so should I go ahead and submit the Form (or) Do I have to edit anything in those fields like, Tax Deducted(5), Unique TDS Certificate No (3), etc. To cross check the same, I have checked in my Axis Bank account statements and this same is not found in the entire account statement in the assessment year 2015-16.

Please help to resolve for safe tax filing.

CAclubindia

CAclubindia